Wind energy tender in the North Sea failed

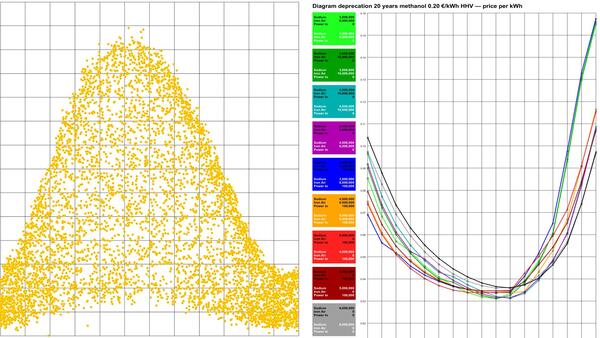

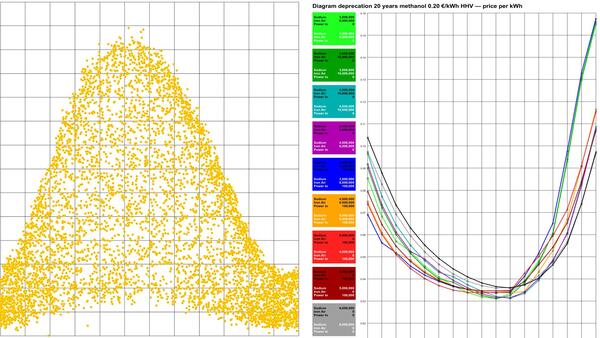

It would be logical to advertise the very best locations first. Next, slightly worse locations and then even worse locations. But a jump from 4,500 full-load hours down to 3,000 full-load hours?

On Tuesday lecture at the Pleyel Cultural Center in Ruppersthal. The lecture was in 3 sections. The second section was: Solar power and storage technology. Do we need wind power?

Video and download PDF here.

Video and download PDF here.

|

The wind energy tender without bids

|

Question to Grok: Reasons for the failure of the wind energy tender in the North Sea. Answer from Grok:

The failure of the wind energy tender for two offshore wind areas in the North Sea (N-10.1 and N-10.2) with a capacity of 2.5 gigawatts in August 2025 can be attributed to several reasons cited by industry associations, experts and the Ministry of Economic Affairs: High investment risks and toxic framework conditions: The current legal requirements and auction design force investors to bear high and incalculable risks, particularly due to fluctuating electricity prices and rising construction costs. The German Offshore Wind Energy Association (BWO) describes the investment conditions as "toxic" and speaks of a "failure with an announcement".

Lack of contracts for difference (CfDs): The industry is calling for bilateral contracts for difference (CfDs) that protect investors against low electricity prices and offer consumers protection against high prices. Without such contracts, profitability remains uncertain, which deters investors. According to the BWO, CfDs could reduce electricity generation costs by up to 30 %.

Geological and geographical risks: The areas put out to tender have greater water depths, which could jeopardize foundation stability and result in higher construction costs. Federal Minister of Economics Katherina Reiche pointed out such risks as a possible deterrent.

Low wind yield due to shadowing effects: The dense development of wind farms in the North Sea leads to so-called shadowing effects, in which wind turbines take wind energy away from each other. According to the Fraunhofer Institute IWES, areas N-10.1 and N-10.2 only offer around 3,000 full-load hours per year, compared to up to 4,500 on other areas, which reduces economic efficiency.

Unattractive power purchase agreements (PPAs): In times of negative electricity prices, customers are less willing to enter into long-term power purchase agreements (PPAs), which jeopardizes the cash flow of the projects. This increases uncertainty for investors as they have to market the electricity generated directly.

Geopolitical and economic uncertainties: Supply chain bottlenecks, rising commodity prices and geopolitical tensions increase the costs and risks for offshore projects. These factors make investments less attractive.

Inadequate auction design: According to industry associations, the current auction design does not take sufficient account of the increased risks. Qualitative criteria, such as the share of renewable energy or early information on PPAs, are difficult to meet and increase uncertainty. The BWO is calling for more realistic deadlines and a reform of the Wind Energy at Sea Act (WindSeeG).

Comparison with other countries: Similar problems occurred in Denmark, where an offshore tender also ended without any bids. Following such a failure, the UK adapted its auction design, which could serve as a model for Germany.

The industry warns that further tenders could fail without reforms, which would jeopardize the energy transition. The Federal Network Agency is planning to put the areas out to tender again in June 2026, but then under the conditions for areas that have not been centrally pre-inspected in order to reduce costs.

|

Market distortions with CfDs

|

"The industry is calling for bilateral contracts for difference (CfDs)", i.e. the industry is calling for market distortions against the market distortion that electricity from EEG plants must be offered at any price, including negative prices.

Let's imagine that strawberries cost €1 per kg in June and €10 per kg in December. Now someone comes along with CfDs: €3 in summer and €8 in winter. Completely stupid, the madness of trying to compensate one nonsense with another nonsense.

The only real solution is to store the electricity. This brings us back to the great act of sabotage against the energy transition: Graichen from AGORA Energiewende brought September 2014 in many mass media: We don't need electricity storage for the energy transition for another 20 years.

|

GEMINI House against offshore wind

|

It would be logical to advertise the very best locations first. Next, slightly worse locations and then even worse locations. But a jump from 4,500 full-load hours down to 3,000 full-load hours? No offer, so the suppliers see no opportunity to earn money by selling electricity on the free market.

This is in stark contrast to the GEMINI next generation house, which aims to revolutionize home financing through energy income instead of energy expenditure.

With the "land for energy" principle, it is even possible to achieve electricity prices that are conducive to the conversion of energy-intensive industry from combustion to electricity: The state receives electricity as rental income and can sell this electricity cheaply to energy-intensive industry.

The central question in any planning for the energy transition must be: can energy-intensive industry be operated with it? The most important energy-intensive industries are: Aluminum, cement, concrete. In the case of aluminum, even a few cents lower electricity prices make it profitable to transport it halfway around the world. Because of the transportation costs, however, a local steel and cement industry makes sense even with slightly lower electricity costs.

When switching from combustion to electricity as an example: the LEUBE cement plant produces 500,000 tons of cement with 110 GWh of electricity and 400 GWh of heat. If we were to switch from heating by burning to electricity, it would be 360 GWh of electricity.

The amount of electricity available and the electricity price must be suitable for such a changeover.

|

Property search for projects

|

I have on ImmobilienScout24.at

searched for properties of 350 m² or more. There are 25 entries on each results page. I looked through the first 19 pages and found 55 suitable plots. The selection criteria were suitable for residential construction and under €200 per square meter. Some were plots of up to 6,500 m², which are already suitable for 10 houses. Only one was in the federal state of Salzburg, none in Tyrol or Vorarlberg. So almost only Upper Austria, Lower Austria, Burgenland, Styria and Carinthia.

The apartments range in size from 56 m², suitable for a retired couple, to 118 m² for a large family. With 2 to 4 rooms there are 56 m² to 97 m². With 4 to 6 rooms there are 89 m² to 118 m².

The houses themselves have between 33 kW and 55 kW of photovoltaics.

If the prototype can be financed quickly now, it will be possible to compensate for the enormous delay caused by the monkey business with the rare lizards: Prototype at the end of 2025, series production from fall 2026.

A simple calculation example: What is a share worth if a company value of 300 million is divided into 150,000 shares?

|

The net-zero emissions mentality

|

Net zero emissions means reducing greenhouse gas emissions to a level that nature can supposedly absorb for a long time. For the rich, this means Maintain poverty, cause poverty, so that enough emission rights remain for the rich. See the architect and her opinion that Africans don't need roads.

|

The planetary restoration mentality

|

Planetary cleanup back to 350 ppm CO2 means about 47,000 TWh of electricity to filter 1 ppm CO2 from the atmosphere and recycle it into carbon and oxygen. Who can afford that? Only a rich human race, 10 billion people in prosperity can do it. One million km² of energy-optimized settlement areas alone should contribute 150,000 TWh for the necessary electricity for world-wide prosperity and planetary restoration.

|

GEMINI next Generation AG will prove the contrary

|

It's not about whether the shares will be worth 100 times or 1000 times more in 20 years' time or whether they will only be worth a few cents. It's about the future of us all. Will there be a big showdown between eco-fascism and yesterday's fossils, or will it be possible to overcome the deep divisions in society and inspire supporters of both sides to work towards a great new goal?

Global prosperity and planetary restoration instead of saving, restricting, renouncing and climate catastrophe or peak oil and a little more climate catastrophe. Both sides must be convinced that they have no solution that is even remotely viable.

On the one hand, it must be shown that net-zero emissions are a completely inadequate target and that the goal must instead be a planetary clean-up back to 350 ppm CO2. The other side must be shown that solar power enables a higher standard of living than fossil energy.

It's about survival! The social situation in 2025 compared to 2005, extrapolated to 2045, makes for a horror world! If we are successful and your shares are worth 100 times more, this is just an addition to all the other achievements.

One new shareholder said "Me with my very modest investment", but €400 times €1,000 is also €400,000 for all investments up to the creation of the prototype.

There is a reward program for recommending the share to others. Two of the new shareholders have become shareholders through this reward program.

Here are the details.

|

GEMINI shares: time to buy - milestones

|

The situation has changed fundamentally since this company visited Slovakia. Necessary investment volume reduced by around 90%. Time to marketable product shortened by around one year. The 90% reduction in investment volume also means that each shareholder has significantly more shares.

The share price is now lifted towards our targets at each milestone. These milestones can happen in all areas: Financial, new shareholders, new opportunities to attract new shareholders. Contracts to build the prototype, more houses and settlements. Cooperations for realization. Purchase, arrival and testing of important technical components. |

Video and download PDF here.

Video and download PDF here.